Optimise store layout with our StoreSpace® retail space planning software

StoreSpace® is the intuitive AutoCAD-based retail space planning software that will enable you to improve the profitability of your stores.

Retail planning software

The past year has seen a drastic effect on retailers across the country, with continuous lockdowns forcing them to close repeatedly. Now that the vaccination roll-out is painting a brighter picture of a post-covid world, retailers are opening their doors once again.

However, April’s online retail sales stayed surprisingly strong, rising 10.2% year on year. While this may concern physical retailers, a survey conducted by Sitecore, found that 43% of GenZ and 37% of Millennials feel guilty about shopping on Amazon, which offers possible hope.

Throughout COVID retailers have had to adapt to changing customer habits, particularly when looking to reduce time spent in-store. According to McKinsey, click and collect services grew 28% year-on-year with 56% of consumers planning to continue using this method of shopping post-pandemic. Building on this, many bricks and mortar retailers are responding by focusing on the in-store experience to entice customers in.

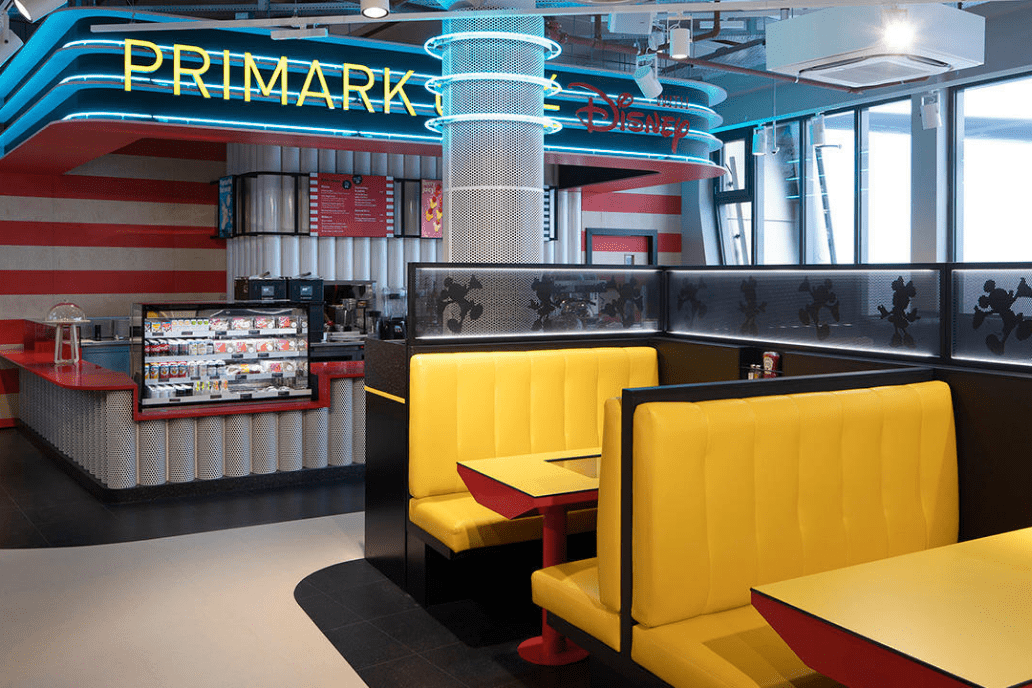

In 2019, Primark opened a Disney Café in its Birmingham store and a few years previous, opened the Insomnia Coffee Shop in its Oxford Street store, giving customers a place to relax and extend their shopping experience. While Apple and Samsung continue to offer product demonstrations and one to one support, to get customers interacting with their products.

Image: Primark Stores

In the US, Fashion retailer Nordstrom has trialled a concept store that is ‘stockless’ so no clothing is actually available for purchase within the store. Customers visit to see selected items on display and get advice from personal stylists on what would suit them and what size to choose but have to order online.

After all, the in-store experience is where online is lacking, and 75% of respondents to an Epson survey said they would change their shopping habits from online to the high street if stores had an experiential element. Although, while 74% of consumers have missed the in-store experience, many are apprehensive about returning to stores (Emarsys).

By implementing StoreSpace® integrated with NielsenIQ planograms, Dominican Republic grocery retailer achieves productivity gains by optimising its retail planning process

Read case studyIn the US, Fashion retailer Nordstrom has trialled a concept store that is ‘stockless’ so no clothing is actually available for purchase within the store. Customers visit to see selected items on display and get advice from personal stylists on what would suit them and what size to choose but have to order online.

After all, the in-store experience is where online is lacking, and 75% of respondents to an Epson survey said they would change their shopping habits from online to the high street if stores had an experiential element. Although, while 74% of consumers have missed the in-store experience, many are apprehensive about returning to stores (Emarsys).

However, Deloitte suggests that while experience remains essential to the future of the store, it needs to be thoughtfully delivered and in keeping with the brand. Disney’s London flagship store is offering animation workshops and movie screenings whereas Dyson is giving customers the chance to test products before purchasing and ethical cosmetics retailer Lush even has an in-store spa that uses the brand’s products.

You either need to be selling something no one else sells (which is nearly impossible), or sell it in a unique way that sets you apart from the others

While augmented reality and virtual ‘try-before-you-buy’ experiences have offered a solution to COVID restrictions with mobile apps from IKEA, Home Depot and Dulux enabling you to preview furniture, products and paint in your own home. Interactive mirrors in fitting rooms enable shoppers to request different sizes or colours or be inspired with other similar items, and Sephora’s Virtual Artist app and magic mirror enables shoppers to virtually try on make-up.

Image: DigitalTrends.com

Home delivered self-cook recipe boxes such as Hello Fresh, Gusto and Mindful Chef have grown in popularity while we’ve been isolated at home and there has been a 121% increase in sales for items containing the words ‘meal kit’ or ‘snack kit’ from 2019 to 2020 (1010data Market Intelligence). Supermarkets in the Netherlands are already matching these products with prices better than the home delivery brands, while Albert Heijn is offering chef-prepared meals for home delivery as a variation.

In response to the 28% growth (McKinsey) in delivery and collect options for grocery, stores such as Tesco have reduced opening hours to make time for packing online orders resulting in fewer supermarkets offering 24-hour opening. Fast track delivery services that aim to get your groceries to your door within 20 minutes, now account for 30% of Moscow’s online grocery market, and order numbers for Deliveroo in the UK have doubled over the last year with Weezy, Gorillas and Dija offering instant grocery deliveries with no substitutes if you live in the right location. Convenience is key and some consumers are becoming accustomed to this way of shopping.

As we have all experienced, the pandemic has changed working practices forever, leading to a growth in shopping locally, pulling the focus away from city hubs. Insurance company Aviva has switched to homework as standard practice and four-fifths of Adecco’s 34,000 staff are now working remotely. This in turn may transform local high streets and pull the focus away from city-hubs with convenience retailers like the Co-op providing for 1.7 million hew households in the first three months of lockdown.

Doug Stephens, Retail Prophet, tells Retail Dive “you either need to be selling something no one else sells (which is nearly impossible) or sell it in a unique way that sets you apart from the others”.

And while necessity has been the mother of invention over the last 15 months in retail, it will be interesting to see what new in-store experiences are created as we explore the new-normal post-COVID.

StoreSpace® is the intuitive AutoCAD-based retail space planning software that will enable you to improve the profitability of your stores.

Retail planning software

An interactive communication tool that brings store changes to life and removes the need for project teams to travel to store.

Virtual tours

Access our accurate retail space planning services to manage & optimise the layout and floor space in your stores..

Retail planning